Emergence of Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the Liquid Chromatography Instruments Market. As healthcare providers increasingly focus on tailoring treatments to individual patient profiles, the demand for precise analytical techniques becomes paramount. Liquid chromatography instruments are integral in biomarker discovery and therapeutic monitoring, enabling healthcare professionals to make informed decisions. The market is likely to benefit from this trend, as advancements in liquid chromatography technology facilitate the development of personalized treatment plans. This evolution in healthcare is expected to drive the growth of the liquid chromatography instruments market, reflecting the industry's adaptability to changing medical paradigms.

Expansion of Food and Beverage Testing

The food and beverage industry is witnessing a transformation, which is positively impacting the Liquid Chromatography Instruments Market. With the rising consumer awareness regarding food safety and quality, there is a growing demand for reliable testing methods to detect contaminants and ensure compliance with food safety regulations. Liquid chromatography instruments are essential for analyzing food products, including the detection of pesticides, additives, and toxins. The market for food testing is projected to grow at a robust pace, with liquid chromatography playing a crucial role in maintaining food quality standards. This trend is likely to bolster the demand for advanced liquid chromatography systems in the food and beverage sector.

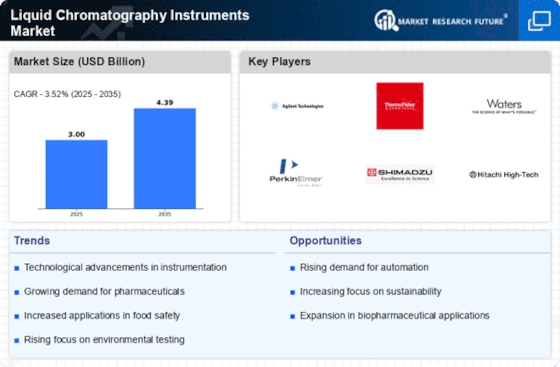

Growing Focus on Environmental Testing

Environmental testing is becoming increasingly critical, thereby influencing the Liquid Chromatography Instruments Market. Regulatory bodies are imposing stricter guidelines to monitor pollutants and contaminants in air, water, and soil. This trend is prompting laboratories to invest in advanced liquid chromatography systems to ensure compliance with environmental regulations. The market for environmental testing is expected to expand significantly, with liquid chromatography instruments playing a pivotal role in analyzing complex environmental samples. The increasing awareness of environmental issues and the need for sustainable practices are likely to drive the adoption of these instruments, contributing to the overall growth of the market.

Rising Demand in Pharmaceutical Sector

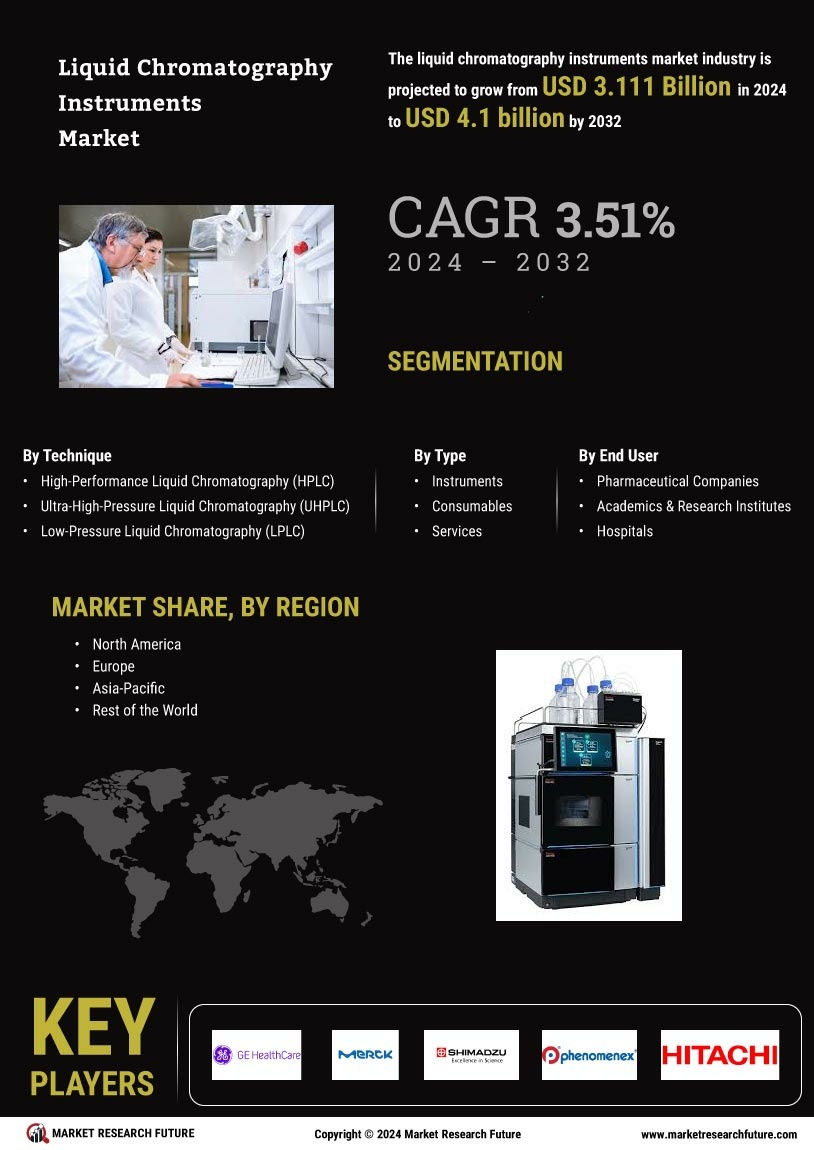

The Liquid Chromatography Instruments Market is experiencing a notable surge in demand, particularly from the pharmaceutical sector. This growth is driven by the increasing need for precise and efficient analytical techniques in drug development and quality control. As pharmaceutical companies strive to meet stringent regulatory requirements, the adoption of advanced liquid chromatography instruments becomes essential. The market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the next few years, reflecting the industry's commitment to enhancing analytical capabilities. Furthermore, the rising prevalence of chronic diseases necessitates the development of new therapeutics, further propelling the demand for liquid chromatography instruments in pharmaceutical applications.

Increased Research and Development Activities

Research and development activities across various sectors are significantly influencing the Liquid Chromatography Instruments Market. Academic institutions and research organizations are increasingly utilizing liquid chromatography for various applications, including biochemical analysis and material characterization. The growing emphasis on innovation and the development of new products are driving the demand for sophisticated analytical instruments. As R&D budgets expand, the need for high-performance liquid chromatography systems is expected to rise, facilitating advancements in scientific research. This trend indicates a promising future for the liquid chromatography instruments market, as it aligns with the broader goals of enhancing research capabilities.